What’s considered an effective rewards strategy has evolved in recent years.

Companies used to brag about their health and retirement benefits, but those have become table stakes. If an organization is going to be competitive as an employer, it must go well beyond the traditional benefits package.

Employers faced with a persistently tight labor market have been looking for every advantage to attract, retain and engage workers. To remain competitive, business leaders need to seriously consider what current and prospective employees need and value. In the process, they’re likely to find that what qualifies as an “employee benefit” is rapidly changing.

Verizon is one employer that’s approaching benefits differently these days. “Our focus is on integrating employee benefits with life to make work easier and better for everyone,” says Sam Hammock, CHRO of the New York City-based telecom giant with about 120,000 employees.

Other organizations set a different baseline. “Quality health care, retirement, parental leave, maternity/paternity leave and generous paid-time-off policies should be foundational in benefit packages,” says Loubna Bribine, HR manager for SES-imagotag, an electronics company headquartered in Nanterre, France. Once those benefits are in place, she says, employers should think about what other benefits they can offer to meet the needs of a variety of people and lifestyles at the company.

An Expanding Perspective on Benefits

The importance of employee benefits is growing and the C-suite is paying attention. “Our executive team talks about benefits quarterly,” Hammock says. This has not always been the case in many organizations. Employee benefits discussions in the past have often focused on the cost of health insurance. For their part, employees and job candidates also tend to take employee benefits for granted and focus instead on compensation.

“Unless an employer is in the top percentile for benefits, just offering slightly more than median has been a hard to sell when salaries dominate” employee and candidate concerns, says Stacey Carroll, president and principal consultant with HR Experts on Call in Seattle.

Yet, smart and targeted investments in employee benefits can yield results, especially when the employees value the benefits. “Everyone focuses on compensation, but there are other levers to pull that really matter to employees,” according to Hammock.

Verizon has made selective and targeted changes to employee compensation, but it has also adopted a benefits strategy that emphasizes maximizing choice. “We are building a range of benefits to serve employees where they are in life,” Hammock says.

To that end, Verizon now offers a stipend that employees can use to purchase personalized benefits that meet their unique needs, such as pet insurance, elder care assistance, yoga classes, telehealth and other benefits.

At the same time, Verizon, like a growing number of employers, is expanding the definition of “benefit” to include the tangible and intangible elements of what an employer offers, including flexibility regarding where and how employees get their work done.

“The power of giving employees the choice of where to work with flexible work arrangements is key,” Hammock says. “Some never want to be in the office and some need the engagement and collaboration that can happen in the office, but most of them just want to be trusted to make that choice themselves.”

Know Your Workforce

So how does an organization determine what benefits to offer and how to allocate spending? It depends. But one thing is clear: The more insight an employer has into its workforce, the more likely it can develop meaningful benefits programs for those workers.

Health care staffing company IntelyCare has leveraged a deep understanding of its workforce of about 50,000 health care professionals into a customized approach to benefits. “Many of our nurses are working additional shifts for a specific reason,” such as paying off debt or saving money for a home purchase, says David Coppins, the Quincy, Mass.-based company’s CEO and co-founder.

In response, the company customized many of its employee benefits to support those goals. For example, the company offers savings plans and access to advantageous interest rates on mortgage loans. IntelyCare’s newest and most popular benefit is the option for employees to access their pay within 15 minutes of completing a shift.

“Even though not all of them have used it, 75 percent of the workforce signed up for this benefit,” Coppins says.

Recognition is another key part of this customized benefits strategy. The company offers bonuses and opportunities to move up various levels based on performance. “Each level offers something new,” such as financial incentives or access to better shifts, Coppins says. This is coupled with consistent positive feedback on employee performance whenever it is warranted. “This is a big change because nursing often has somewhat adversarial relationships [between nurses and] management, so we emphasize our respect for their work,” he says.

Of course, offering these targeted benefits is only the starting point. Coppins also makes sure these benefits investments are helping the company achieve its goals. So far, the news is positive: Employee retention levels have almost doubled, and there has been a 40 percent increase in engagement, as measured by how many shifts individuals are taking per month.

When in Doubt, Ask

With thousands of employees in every demographic group, Verizon’s employee benefits have to cover many bases. “We have young professionals early in their careers, employees who are parents, and long-tenured employees,” Hammock says. “Our focus is on whether we have the benefits that provide the choices” that can meet the needs of this very diverse group.

To that end, Verizon conducts quarterly employee engagement surveys and supplements those findings with feedback through other channels, including focus groups. As with many companies, employee attrition at Verizon has been higher than normal since the pandemic, and the company is looking for ways to increase retention.

‘Everyone focuses on compensation, but there are other levers to pull that really matter to employees.’

Sam Hammock

For company leaders, the pandemic led to a broader perspective on what mental health and wellness means for many workers. For example, in addition to offering traditional mental health support like employee assistance programs and access to therapy, Verizon significantly expanded its support for caregivers. With people working remotely, “sometimes mental health means that you just need to get out of the house,” Hammock says. “We provide backup care at any time for employees with any kind of caregiving responsibilities.”

Global companies may also need to act on employee feedback based on geography. With offices in 15 countries, SES-imagotag recognizes that benefits valued by employees in one region or office may not appeal to employees in other locations. For example, when the company’s surveys indicated that employees in North America value more downtime, the company acted to meet this need by closing all of its offices in this region during the U.S. Thanksgiving holiday week.

This decision also meshed with the company’s strategic needs. As a supplier of electronic shelving systems for the retail industry, this break is a good time for employees “to spend time with their loved ones so they can come back rested and ready for the holiday season,” Bribine says.

SES-imagotag’s survey data also showed that employees want to have a positive impact on their communities. Therefore, to support community involvement, the company matches up to $500 in charitable contributions and introduced two paid volunteer days per year. “We also provide local opportunities to employees who are looking to volunteer but don’t know where to begin,” Bribine says.

|

|

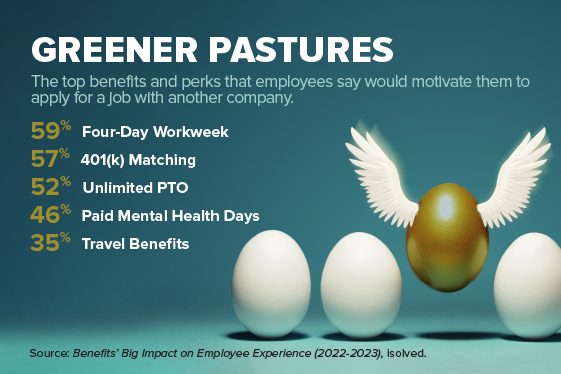

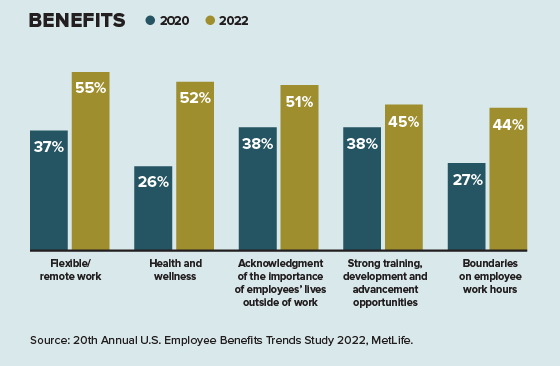

New programs and benefits strategies adopted by employers during the pandemic provided a glimpse of what’s possible in employee benefits. To remain competitive, employers know they have to provide employees with core health care and retirement plans. The opportunity to stand out among employers comes from offering other, targeted benefits. Out of necessity, employers continue to invest in new employee benefits programs to support workers and help them address the challenges they face in their personal and professional lives. Although specific wants and needs will differ for each employee, these benefits have become “must-haves” for workers considering new job opportunities over the past two years:  |

Building a Dashboard

Maintaining a strong workforce in health care is difficult even in the best of times. Due to the pandemic, the past few years have not been the best of times.

For Paul Dann, executive director of NFI North Inc., a nonprofit health care agency based in Contoocook, N.H., meeting that challenge meant determining why people were quitting—and finding ways to address those issues.

The agency, which has 400 employees and serves patients in Maine and New Hampshire, developed a dashboard to measure longevity by position and to identify when people were most likely to seek another opportunity. “We found that people are most likely to leave during the second and third years,” Dann says. The key reasons turned out to be the relationship with their manager, not understanding the value of employee benefits and unhappiness with pay levels.

The agency was able to quickly address the compensation issue by increasing the starting hourly rate and offering hiring and retention bonuses. It took longer to increase management training and leadership development to start to improve relationships. That left the last issue—employee benefits.

The agency began by communicating about the value of its retirement plan and the 5 percent of pay the agency contributes on employees’ behalf. Then, it looked for new programs that would appeal to employees. That required adopting a much broader definition of employee benefits. For example, at employees’ request, the agency created a shared sick-leave bank to which employees can donate some of their sick leave and from which they can draw time off if needed.

However, the main focus was helping employees build a stronger work/life balance by giving them more control over when and where they work. As a health care agency, NFI North had given little thought to remote work. However, after analyzing specific jobs, the agency found that at least some of the work could be done remotely.

“We outfitted everyone whose position allows for remote work with the necessary technology so that they can work remotely up to three times a week,” Dann says. At the same time, the agency gave employees the option to compress their normal, full-time hours into a four-day week instead of five as long as they spend at least two of those days in the office. “Although it seems simple, this represented a real paradigm shift for us,” Dann says.

Lasting Value

As more employers are learning, a greatly expanded definition of employee benefits is required.

“Right now, benefits are the most important thing employees look for in addition to culture and work purpose,” says. Nick Shah, founder and CEO of Peterson Technology Partners in Park Ridge, Ill. “Most people are looking for the whole package—a company culture of learning, growth with flexible work conditions and cutting-edge, cool work to do—that will keep them motivated in the long term.”

‘Employers need to rethink everything about rewards.’

Stacey Carroll

Senior executives who seize this opportunity to redefine employee benefits can generate lasting value for their organizations.

“Employers need to rethink everything about rewards, including where and how people work and how they build and develop a career,” HR Experts on Call’s Carroll says. “Employees want a new model that’s flexible and personal.”

It’s important to start the conversation about what this type of approach to benefits would look like, not only now but in the future. HR cannot do this alone. Carroll notes that organizations are most effective when these conversations include perspectives from people outside of HR. Organizations that are least effective are not having this conversation at all.

Joanne Sammer is a New Jersey-based business and financial writer.

Explore Further

SHRM provides advice and resources to help business leaders make the most of their benefits investments.