?Takeaway: When having an employee sign an arbitration agreement, a company should obtain convincing proof of the authenticity of the signature. If the agreement is signed electronically from a work computer, the... Read more »

?On July 20, a bipartisan group of legislators introduced a bill in the U.S. House to allow businesses to continue classifying their gig workers as independent contractors, while providing the gig workers... Read more »

?New York City’s Wage Transparency Law takes effect Nov. 1, and employers—including businesses outside the city with job ads for remote work—are realizing one of the unintended outcomes of complying with the... Read more »

Department of Labor (DOL), Equal Employment Opportunity Commission (EEOC) and National Labor Relations Board (NLRB) regulations may receive less deference following a pair of U.S. Supreme Court decisions last term, including one... Read more »

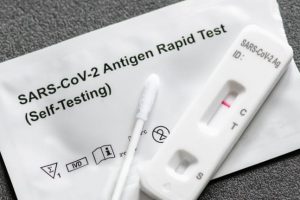

Employers with workers who test positive for COVID-19 should follow guidance from the Centers for Disease Control and Prevention (CDC), including its guidelines on quarantining and isolation, to minimize safety and legal... Read more »

?The Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act of 2022, passed by the Senate and House of Representatives, not only has provisions to boost domestic production of computer chips... Read more »

?National Labor Relations Board (NLRB) General Counsel Jennifer Abruzzo and Federal Trade Commission (FTC) Chair Lina Khan entered a memorandum of understanding on July 19 to form a partnership between the agencies... Read more »

?The U.S. Supreme Court recently refused to consider whether California’s controversial worker classification law should be blocked by a federal law that regulates the trucking industry. The court’s action on June 30... Read more »

?In 2020, California passed Assembly Bill (AB) 1731, which created an alternative process for employers to submit and be approved for work-sharing plan programs. Previously some employees would be eligible for unemployment... Read more »

?As more employers roll out hybrid work policies, there are many complex legal considerations to take into account. Hybrid work impacts tax compliance, reimbursement for work expenses and prohibitions against discrimination, among... Read more »